USING FUZZY LOGIC FOR PRICING

Acácio Magno Ribeiro

Electrical Engineering Department, Federal University of Juiz de Fora, Cidade Universitária, 36036-330 Juiz de Fora,

MG, Brazil

Luiz Biondi Neto, Pedro Henrique Gouvêa Coelho

Electronics and Telecommunications Department, State University of Rio de Janeiro,

R

ua São Francisco Xavier, 524, Bl. A,

Sala 5036, Maracanã, 20550-013, Rio de Janeiro, RJ, Brazil

João Carlos C. B. Soares de Mello, Lidia Angulo Meza

Production Engineering Department, Fluminense Federal University, Rua Passo da Pátria, 156, São Domingos, 24240-

240, Niterói, RJ, Brazil

Keywords: Pricing, Fuzzy S

ets, Risk Assessment

Abstract

: This paper deals with traditional pricing models under uncertainties. A fuzzy model is applied to the

classical economical approach in order to calculate the possibilities of economical indices such as profits

and losses. A realistic case study is included to illustrate a typical application of the fuzzy model to the

pricing issue.

1 INTRODUCTION

Most of current challenges in electrical system

management issues are concerned to the new

world’s environment i.e. competition and

deregulation. The performance of a company should

be measured not only by its product quality but also

by the efficiency of its business in order to achieve

good contracts with low risks and high profits.

One of the major fundamental tasks related to the

n

ew competitive reality is pricing a contract which

can be a tough challenge.

The objective of this paper is to describe a new

com

putational tool customized for the risk

assessment. The mathematical model is based on the

application of fuzzy sets to the classical economic

theory and the overall solution scheme aims to

provide an effective and reliable help to the Decision

Maker on the new challenges of a competitive

environment.

2 CLASSICAL ECONOMICS

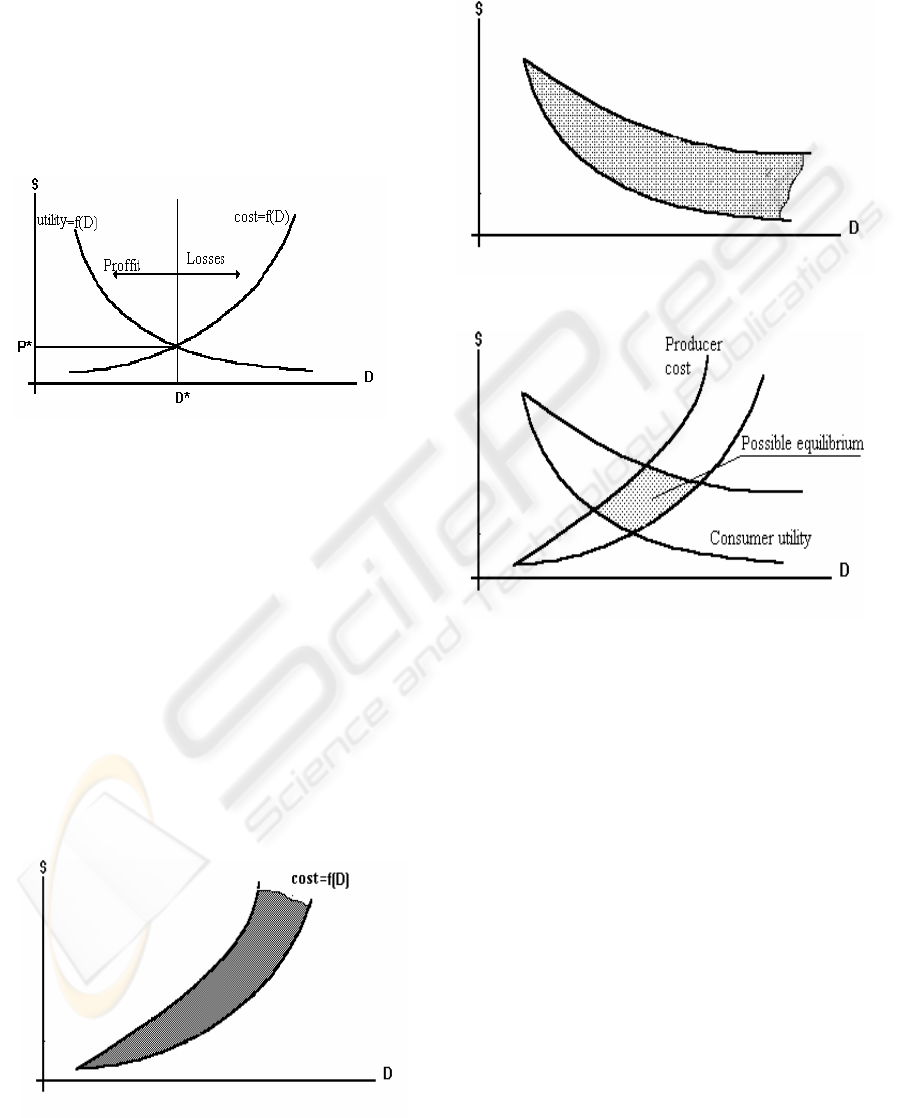

In a very simplified way, the classical economic

theory (Mas-Colell et al., 1995; Sher et al. 1986;

Varian 1992) establishes a product price based on

two main functions illustrated in Figure 1: the

production cost and the consumer utility. It is

important to note that every cost is associated to a

desired (or sometimes regulated) quality (reliability,

security) level. Therefore, the presented function

must be regarded as the minimum total cost

necessary to supply the load under corresponding

quality constraints.

Theoretically, in ideal conditions such as perfect

mark

et, competition, etc., the equilibrium between

offer and demand is achieved when the price equals

production costs – the break-even point corresponds

to demand D* cha

rged at price P*. However, it

should be noted that the future demand will not

necessarily equal to the optimal D*. A good load

management scheme would therefore bring the load

to the “profit” region; any commitment to supply

load at the “losses” region would require

331

Magno Ribeiro A., Biondi Neto L., Henrique Gouvêa Coelho P., Carlos C. B. Soares de Mello J. and Angulo Meza L. (2005).

USING FUZZY LOGIC FOR PRICING.

In Proceedings of the Seventh International Conference on Enterprise Information Systems, pages 331-334

DOI: 10.5220/0002548703310334

Copyright

c

SciTePress

compensation in order to maintain a company

economically healthy.

It is interesting to observe that the utility would

achieve profits whenever the demand is lower than

D* (on the left side of the break-even point, where

the user accepts a price higher than production

costs), and losses if the demand is higher than D*. A

good load management scheme would therefore

bring the load to the “profit” region; any

commitment to supply load at the “losses” region

would require compensation.

Figure 1: Production cost and Utility functions

This paper considers a model that extends the

classical economic theory to accommodate

uncertainties. It uses a specialized optimal

expansion/ operation model to evaluate a family of

possible minimum cost functions associated to each

possible future scenario. One example of such

functions is illustrated in Figure 2, defining the

possibility region of production costs. As may be

seen, each point of the region corresponds to the

optimal operation (or, if desired, operation and

expansion) cost necessary to supply a given load.

The overall optimization algorithm is fully described

in (Camac, 1998). Fast minimum cost flow and

parametric programming algorithms were specially

designed and developed in order to make it possible

to construct the region within a reasonable

computational effort.

Figure 2: Possibility Region of Production Costs

The same reasoning may be used to construct the

family of utility functions and therefore the

possibility region of consumer’s utilities illustrated

in Figure 3.

Figure 3: Possibility Region of Consumer Utilities

The resulting region is illustrated in Figure 4.

Figure 4: Possibility Region of Equilibrium

It may be seen that the equilibrium point will lie

within a region delimited by the possible production/

consumption scenarios.

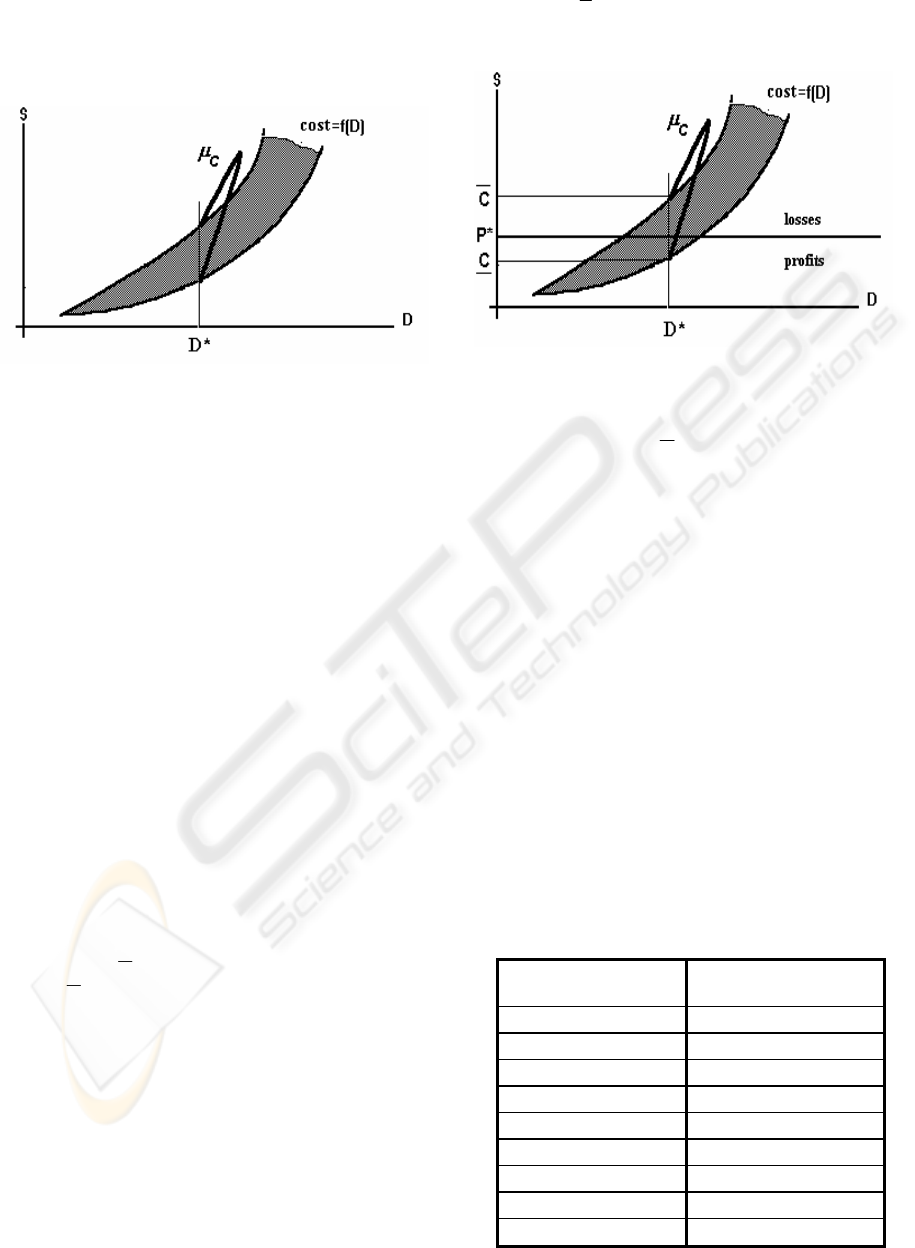

3 FUZZY MODELING

This paper uses the fuzzy set theory as a basis to

model the possibility regions of costs and utilities

and construct a risk assessment framework. Each

scenario of production cost and consumer utilities is

assigned a corresponding possibility

µ

c

or

µ

u

.

(membership functions in fuzzy set theory). Figure 5

illustrates the possibility cost function for demand

D*.

It may be shown that the possibility of a

future scenario s where cost

and utility

jointly occur is given by

∗

c

∗

d

∗∗

+

=

uc

s

µ

µ

µ

(1)

ICEIS 2005 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

332

Using the same reasoning one could

accommodate uncertainties in load values, growth,

fuel costs, etc. The total scenario possibilities will be

the union of each individual possibility.

Figure 5: Possibility Function for a Scenarios

Energy pricing is a multi-disciplinary task and

involves efforts of many different people in a

company. A realistic price structure is generally

based on complex philosophies, objectives and

goals, and cannot be briefly described, as

commercial interests and contractual constraints

prohibit a comprehensive and detailed report.

Nevertheless, an intuitive reasoning would state that

the price must cover costs and the consumer must be

able to pay the price.

The quality of a business (for instance, a sales

contract) will be measured by indices, such as

incomes, profits, etc. A realistic quality index should

reflect the company’s philosophies and goals, and

may combine more than one component (for

instance, incomes, profits and risks) in order to

suitably represent the company’s aims and

objectives.

In general, it is better to loose a business than to

do a bad business. Our first analysis will focus on

the first need of a company to recovering expenses.

Suppose, for instance, that the decision maker must

price a supply of D*, whose associated costs are

presented in Figure 6, ranging from lower and upper

bounds

C andC .

Considering a given price P*, it may be seen

that, for scenarios corresponding to costs lower than

P*, there is a positive profit

α

given by

** CP −=

α

(2)

Conversely, the company will experience

losses, or a negative profit, if costs are higher than

sales price. The possibility of losses may be

evaluated by

∫

=

C

P

cl

*

µφ

(3)

Figure 6: Pricing based on Production Costs

where the integral operation is performed under the

D* constraint and represents the accumulated

possibility from P* to

C

.

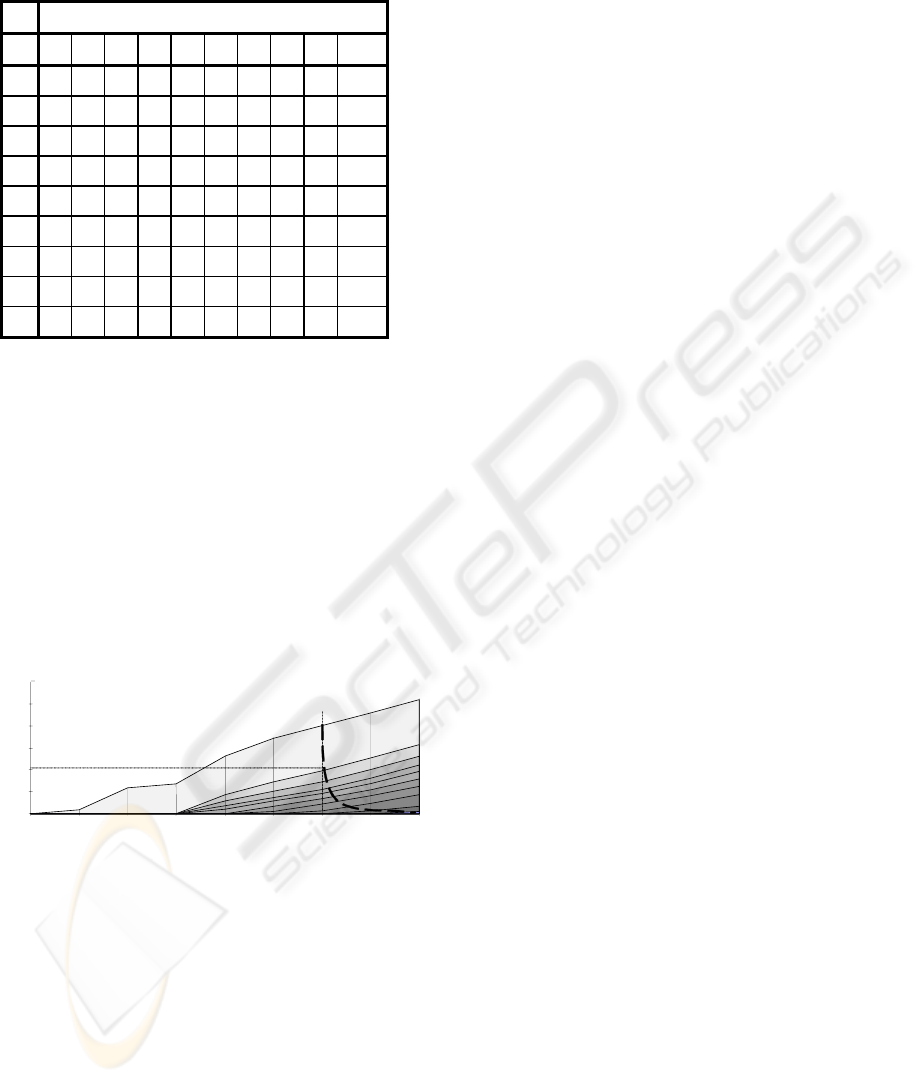

4 CASE STUDY

The described model was applied to a realistic

Peruvian system. In order to protect confidential

information, only part of the system was modeled

and some key parameters were slightly changed.

Therefore, the obtained results cannot be interpreted

as real and do not reflect company data, targets,

costs or prices. The represented system is composed

by 5 hydrological plants (total installed capacity of

1500 MW) and one thermal plant (total installed

capacity of 250 MW). In this simple case, no

investment costs will be considered. However,

practical applications of the proposed model may

include operation and investment costs.

The nine possible future load scenarios are

presented in Table1.

Table 1: Possible Demand Scenarios

Possible Scenario Demand (GWh)

1 510

2 612

3 734

4 807

5 888

6 933

7 979

8 1028

9 1080

USING FUZZY LOGIC FOR PRICING

333

Table 2: Production Costs for each possible

scenario (Millions of US$)

Table 2 presents corresponding production costs for

ten possible hydrological inflows.

The Decision-Maker must choose an offer

price for a contract of 1000 GWh supply along a

two-year horizon. According to company, pricing it

should follow a Cost-recovering philosophy, and a

5% maximum risk of losses. Figure 7 presents the

fuzzy region of production costs as a function of the

supplied load. For simplicity reasons, a cumulative

scenario possibility function is represented. It may

de seen that the price associated to a 5% risk of

losses is slightly above US$ 4000 million.

Figure 7: Fuzzy Cost Production Region

5 CONCLUSIONS

This paper presented a model for the risk assessment

of an electrical system under a competitive

environment. The proposed approach extensively

used efficient optimization algorithms to build the

regions of possible future scenarios. A fuzzy

reasoning framework then treated these possibility

regions in order to obtain the strategies

corresponding to the company’s objectives. It is

interesting to notice the difference between the

proposed and the classical tools. While the classical

approach requires the user to adopt a given objective

(for example minimum operation costs, minimum

variance, minimum regret, etc.), the new model

adapts to the user targets and philosophies,

producing the adequate results to the new company

needs. The presented model aims to be an effective

and useful tool to risk analysis and management.

HYDROLOGICAL SCENARIOS

1 2 3 4 5 6 7 8 9 10

1 0 0 0 0 0 0 0 0 0 0

2 0 0 0 0 0 0 0 0 0 367

3 0 0 0 0 0 0 0 0 6 2396

4 0 0 0 0 0 0 0 2 22 2724

5 0 0 0 0 5 401 740 1149 1759 5281

6 0 0 0 218 697 1138 1502 2053 2916 6944

7 0 3 241 914 1393 1865 2243 2928 3887 8063

8 1 250 972 1653 2169 2732 3229 4009 5062 9239

9 228 696 1759 2470 3165 3885 4463 5243 6296 10472

REFERENCES

C. J. Andrews, "Evaluating Risk Management Strategies

in Resource Planning", IEEE Transactions on Power

Systems, Feb. 1995, Vol 10, Number 1, pp. 420-426

Mas-Colell, Andrew, Whinston, Michael D. and Green,

(1995). "Microeconomic Theory, Oxford, Oxford

University Press.

Sher, William and Pinola, Rudy, (1986). "Modern Micro-

Economic Theory. North-Holland - New York.

Varian, Hal R. (1992). "Microeconomic Analysis". W. W.

Norton & Company- New York.

D. Camac, “A Model for the Optimal Planning and

Operation of Hidrothermal Systems”, D.Sc. Thesis,

1998 (in portuguese)

COSTS

0

2000

4000

6000

8000

10000

12000

µ

Milions of US$

10

9

8

LOAD

10000

5%

ICEIS 2005 - ARTIFICIAL INTELLIGENCE AND DECISION SUPPORT SYSTEMS

334