NEW TRENDS OF E-COMMERCE IN SPAIN

Israel González-Carrasco, Jose Luis López-Cuadrado, Belen Ruiz-Mezcua, Angel García-Crespo

Department of Computer Science, Universidad Carlos III ,Madrid, Spain

Keywords: eCommerce, electronic purchase, virtual point of sale, legislation, security.

Abstract: eCommerce can be defined, in an ample sense, as any form of commercial transaction based on the remote

data transmission on communication networks. In order to facilitate this process, the market at the moment

offers an ample range of electronic payment systems that allow to make electronic purchases with simplicity

and transparency, being helped to harness the sales and to manage them of efficient way. This article

presents, in the first place, the current situation of the electronic commerce in Spain, detailing the state of

the used technology, its real possibilities of use, the new methods of payment, the security used in the

process and the influence that it has in the market. Secondly, is a proposal of virtual store in which different

technologies are integrated to make the process of purchase software product. The designed website

innovates in the implemented modality of payment, considers the effective legislation at the present time in

Spain, and it makes agile and assures the process purchase with the activation of each product in an

individual way.

1 INTRODUCTION

eCommerce constitutes a new form of enterprise

strategy that is based on the use of the

communication networks to develop commercial

activities. In this new model of business

transactions, the involved parts exclusively interact

and make businesses through electronic way (Pastor,

2002).

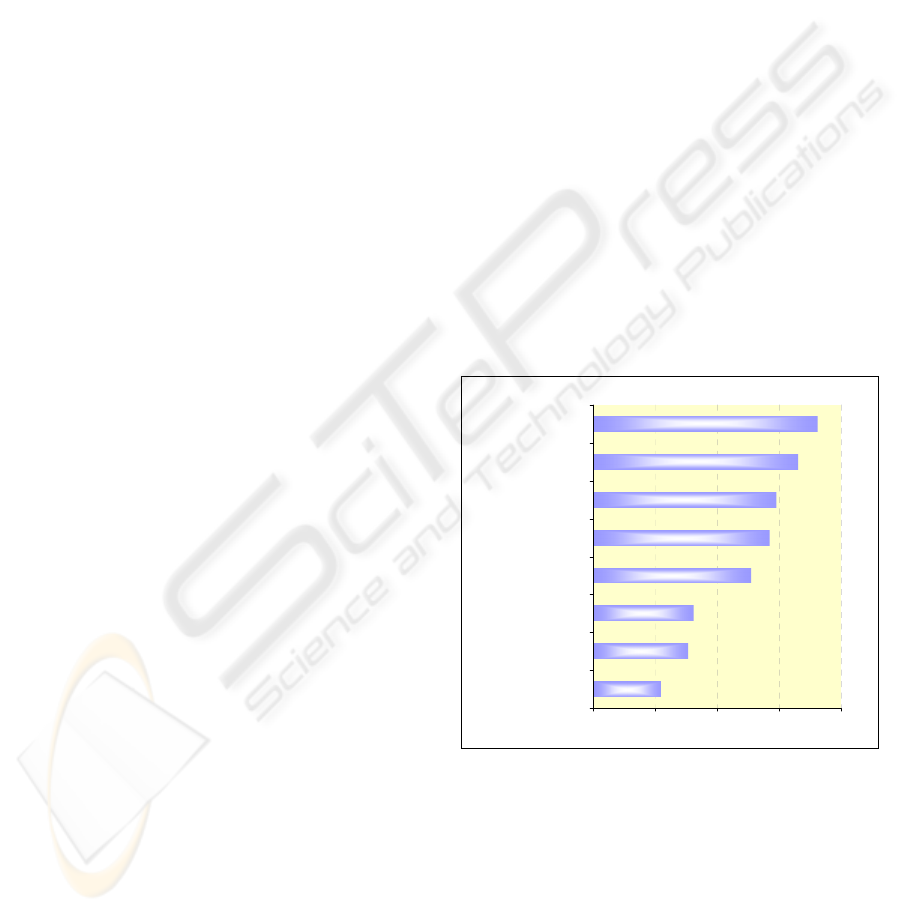

Figure 3 shows the main places of purchase in

Spain, extracted from the last study on electronic

commerce B2C of AECE (AECE, 2004). The

traditional store with Web is the one that greater

uses, followed of the Web of the manufacturer. In

addition, the use of sites dedicated exclusively to

this service, at the moment is used moderately.

0,00% 5,00% 10,00% 15,00% 20,00%

Traditional Shop

Manufacturer Web

e-Shop

e-Mall

e-Auction

Virtual Community

Other s

Dont Know

Figure 1: Purchase places classification in Spain

In Spain the main electronic payment, is still the

credit card, on the contrary is losing use the payment

by direct debit, as well as the cash on delivery, and

appears the use for the first time of the card of the

own establishment (AECE, 2004).

159

González-Carrasco I., Luis López-Cuadrado J., Ruiz-Mezcua B. and García-Crespo A. (2005).

NEW TRENDS OF E-COMMERCE IN SPAIN.

In Proceedings of the Second International Conference on e-Business and Telecommunication Networks, pages 159-163

DOI: 10.5220/0001411501590163

Copyright

c

SciTePress

0,0% 10,0% 20,0% 30,0% 40,0% 50,0% 60,0% 70,0%

Cards

C ash on delivery

Payment by direct

debit

Transfers

Shop card

Others

Dont Know

2003 2004

Figure 2: Electronic payment classification in Spain

2 ELECTRONIC PAYMENT

SYSTEMS

The electronic payment par excellence actually

through Internet is the card, as much of debit as of

credit, and this has been possible thanks to the

appearance of the electronic payment systems, that

emulates of electronic form the normal transaction

between merchant and client, guaranteeing the good

aim of the operation.

The electronic payment systems or virtual points

of sale terminal (POS), acts in Internet like the

traditional payment systems of credit card (physical

POS) allowing that their clients can pay their

products through Internet using a credit card

(Bartolome, 2002).

It is important to consider that the system of

payment developed by the different banks does not

provide an application of commerce in himself, they

only implement a payment system. Anyone

connected to this network can acquire these

products, from any place and during the 24 hours of

the day, having a personal computer and a

connection to Internet.

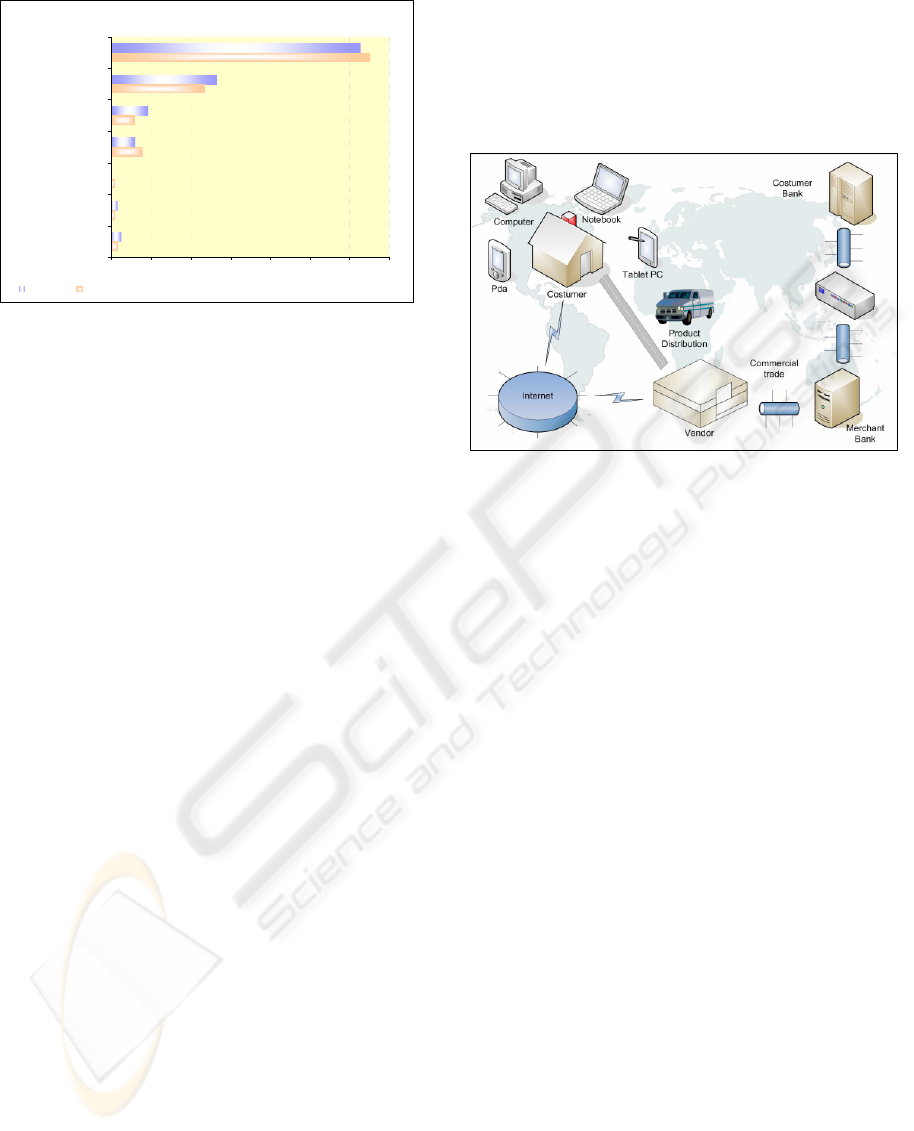

The participants who take part in a transaction of

this type are the following ones:

Customer or client, is the one who initiates

the transaction, details the content of the

purchase and interact with the POS,

specifying in a secure form the data of his

card.

Vendor or merchant, who recognizes the

identity of the client to send the merchandise

to him, once authorized the operation by the

POS. It is necessary to stand out that the

retailer does not have access to the economic

data of the transaction, these confidential data

are privatized between client and bank.

Customer Bank or financial organization of

the client, which receives the payment order,

consults the identity of the card and notifies

the viability of the operation

Merchant Bank or financial organization of

the retailer, which receives the money in its

account.

Figure 3: Electronic purchase process participants

3 E-COMMERCE LEGISLATION

In Spain, the product sale and services through

Internet are basically regulated by the European

directors on electronic commerce and by Law 7/96

of Arrangement Commerce Retail (MAP, 1996).

To legal effects, the sale by Internet is governed

by the criteria that the remote sale and, therefore, it

has the same treatment that the sale by telephone,

catalogue or mail. The norm on the remote sale

gathers the possibility that the transactions of

purchase are rejected made by two reasons:

Disagreement of the buyer with the acquired

product.

That the purchase has been made with credit

or debit cards by non-authorized people or

who they are not his holders.

In order to assure the transaction, the companies

that commercialize their products or services by

Internet, must obtain and verify all the possible

information about the buyer the data before deliver

the product. The more important basic norms that

they are applied to the electronic commerce and

transactions by Internet in Spain at the present time

are (Casas, 2003):

Law 7/96 of Arrangement of Retail

Commerce.

RD 1906/99 of 17/12/1999 to regulate the

general conditions of telephone or electronic

hiring.

Director 200/31/CE of ecommerce.

ICETE 2005 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

160

Law 34/2002, Services of the Society of

Information and electronic commerce (LSSI)

of 11/07/2002.

Law of Protection of Personal character Data

of 13/12/1999 (LOPD).

RD 994/1999 that establishes the measures of

control of security of the automated files.

RD 195/2000 that establishes the time to

implement the measures of control of security

of the automated files.

Director 1999/93/CE on digital certification.

4 E-COMMERCE

CHARACTERISTICS

In a system of electronic commerce the following

characteristics are due to guarantee (Reynolds,

2000): anonymity, trazability, confidentiality,

authentication, data integrity, non repudiation and

reliability. Finally to comment that in addition to the

previously commented requirements of security,

exists other directed to make the mechanisms more

effective: low cost, independence of the hardware

and operating systems, scalability, effective

mechanisms of auditation, confidence on the part of

the consumer.

5 BARRIERS IN THE

DEVELOPMENT OF

ELECTRONIC COMMERCE

It is a fact that the electronic commerce has not

experienced the growth nor the acceptance that the

initial enthusiasm foretold for the immediate future.

Several factors act of brake to the expansion of the

commercial activity in Internet, being the main ones

(Meseguer, 2003):

The privacy: The end users feel threatened

their privacy, if they do not know if the

personal data that they provide to a servant of

electronic commerce will be dealed with

confidential form.

The authentication. The users doubt if the

person with whom they communicate he is

truely who claims to be.

The global security. The users fear that the

technology is not sufficiently robust to

protect as opposed to attacks and illegal

appropriations of confidential information,

specially in the payment process.

These fears have their real foundation and its

solution is not trivial. In the first case, the

technology, and in concrete the cryptography, offers

the necessary tools for the protection of stored

information in corporative databases. In the second

case, the immediate solution that it offers the

cryptography comes from the hand of digital

certificates. As far as the third fear, the modern

cryptography and the products of security provide

the solutions to the problems again. Therefore, it is

possible to be affirmed that the true barriers to the

electronic commerce are not as much technological

as human, since the technology has been able to

surpass the difficulties that have been appearing to

assure the process of electronic purchase.

6 SOLUTION PROPOSED

In the article we present the designed and

implemented prototype. One is a virtual store, in

which a electronic payment system has been

integrated that allows the commercialization of

software for mobile devices. This type of

applications has a great importance in the present

market since they facilitate mobility, increase to the

range of users and the possibilities of use.

The created system includes a series of

interesting new features, first of them is the method

of electronic payment chosen to make the product

purchases in the site. In Spain the method payment

par excellence are the credit card (AECE, 2004),

being this including in most of sites. In our case we

have chosen a novel form to realize these operations,

for it the clients must associate the data of their

credit cards or current accounts with a resource that

allow the direct communication with us, in this case

the electronic mail or the mobile telephone. When

doing this, the client creates a payment portfolio that

only can be managed through the resource chosen,

allowing making payments and taking a detailed

control of the realized operations.

Another novel aspect is the necessity to activate

the product before being able to use it in the

movable device. Thanks to this, the system improves

the scalability, personalization and availability in

real time of the products, since at any moment the

unloaded and activated copies of software can be

known.

In summary, to be able to begin to use anyone of

products, the clients must make the following

process:

Download his compatible version of software

its device.

Make the purchase of the product through a

POS that use the electronic mail instead of

the credit card.

A purchase code is given back to the user.

NEW TRENDS OF ECOMMERCE IN SPAIN

161

To activate the bought product

The client must introduce the data of chosen

software and the code of purchase obtained

when paying

The site sends to the client the code of

activation to the specified email.

Figure 4: Purchase steps within the web site.

In order to assure this process unloading - sale -

activation, the products of the site are sold in

individual way giving back for each one of them a

purchase code that allows its later activation. By this

the concept of "shopping cart" has not been used, it

is to say products are sold separately and by means

of independent processes of purchase.

The data necessary to make the activation,

information of products and the client are stored in a

centralized data base. The architecture of the system

therefore is structured in three levels, light client -

servant of applications - database Server.

6.1 Personal data storage

The effective legislation in Spain, LOPD, establishes

that it is necessary to notify in the Data Protection

Agency all the files that contain personal character

data (clients, suppliers, associate, personnel, etc)

which they allow to identify physical people.

In the case of the created web site, the only data

that is stored is the email of the purchaser, which by

itself does not consider information that can cause

lost or damages to the client. This single data is used

to make the dispatch of the activation code, in this

sense is recommendable, but no obligatory, to

communicate the article 5 of the LOPD (MI, 1999),

including a clause in the own electronic mail (of this

form, a greater security about the origin of the data

and the identity of the file owner is obtained).

If the purpose of the email stored was to make

indiscriminate shipment of mails containing

publicity or promotions, is due to consider that its

prohibit from the approval of the LSSI (MITC,

2002). In this point LLSI, says that the Spam made

by Spanish companies or which they have an

establishment in Spain is prohibited.

On the contrary, if they only want to send

electronic advertising, it’s necessary to obtain the

express consent of the user (making click in a field

specifically prepared for it), not being valid those

abusive clauses that they suppose a consent no

emitted specifically.

In the case of collecting more personal data, as

for example the full name if it would be obligatory

to register the data base used to store the data of

activated products. To clarify in this point, that the

data gathered in this form are not going to be

provided to third parties and the user has the

possibility of modifying them or of eliminating them

through the contact section of the web site.

7 CONCLUSIONS

This paper make a revision of the aspects most

important to consider in the processes associated to

the electronic commerce. In this sense the electronic

commerce is a useful tool to make businesses, but

the existing distrust has put in doubt its

development. Therefore a very important aspect, due

to the type of information that is handled, is the

relative one to the security necessary to guarantee

the transactions.

Is an interesting fact that in all activity of

purchase, which continues worrying is the operation

of payment, that is to say, the moment in which the

buyer faces the window where has introduced its

credit card data and doubt at the time of pressing the

button "Send". Therefore, one of the main

conclusions extract is that the true barriers that

restrain the ecommerce development are not as

much technological as human. At the present time

the existing technology is able to guarantee the

privacy and the security of the made transactions.

As fundamental conclusion, the propose solution

innovates no single in the implemented modality of

payment, but that in addition considers the effective

legislation and makes agile and assures the process

purchase with the activation of each product in an

individual way. When activating the product we

improved the scalability, customisation and

availability in real time of the same one, since at any

moment it allows to know unloaded and activated

copies of software. The developed system has been

designed in such a way that in future new

functionalities and improvements can be introduced

easily and quickly. Among them, emphasizes the

possibility of including in all the pages of the site

compatibility with standard WAI

(http://www.w3.org/WAI) and access multi device.

ICETE 2005 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

162

This would allow increasing the usability,

accessibility and mobility of the site users.

REFERENCES

ACTS Guideline SII G9, 1998. Electronic Commerce.

Asociación Española de Comercio Electrónico (2004),

Estudio Comercio Electrónico B2C en España 2004.

Bartolomé, T., Iturraspe, U. (2002), Negocio Electrónico:

Pasarelas de Pago. Robotiker electronic review, n 11.

Casas, R. (2003), Legislación de Internet y comercio

electrónico, Ed. Tecnos.

Hayes, J., Finnegan, P. (2003), Electronic business

models: a synthesis and field study.

Meseguer, A. (2003), Situación y perspectivas del

comercio electrónico en España: Un análisis a través

del volumen del negocio electrónico, Esic market.

Ministerio de Administraciones Públicas. (1996), Ley

7/1996, de 15 de enero de Ordenación del Comercio

Minorista.

Pastor, C., Martinez, C. (2002), ABC del Comercio

Electrónico, Robotiker electronic review, n 0.

Pilioura, T. (1998), Electronic Payment Systems on Open

Computer Networks: A Survey. Electronic Commerce

Objects, D. Tsichritzis (Ed.), Centre Universitaire

d'Informatique, University of Geneva, July 1998, pp.

197-228.

Pfleeger, C. (1996), Security in computing, Second

Edition. Englewood Cliffs, NJ: Prentice Hall.

Reynolds, Jonathan (2000), eCommerce: a critical review.

Internacional Journal of Retail and Distribution

Management, Vol. 28, N. 10. pp. 417-444.

Smith, M., Bailey J., Brynjolfsson E. (1999),

Understanding Digital Markets: Review and

Assessment. The Digital Economy, MIT Press,

Cambridge.

Vázquez, E. y Berrocal, J. (2000), Comercio electrónico:

materiales para el análisis, Ministerio de Fomento.

NEW TRENDS OF ECOMMERCE IN SPAIN

163